Post-Op Follow-Up Schedule That Prevents Prosthetic Delays (For Clinicians)

For many clinicians, the surgery is only the first step. What happens after the operation

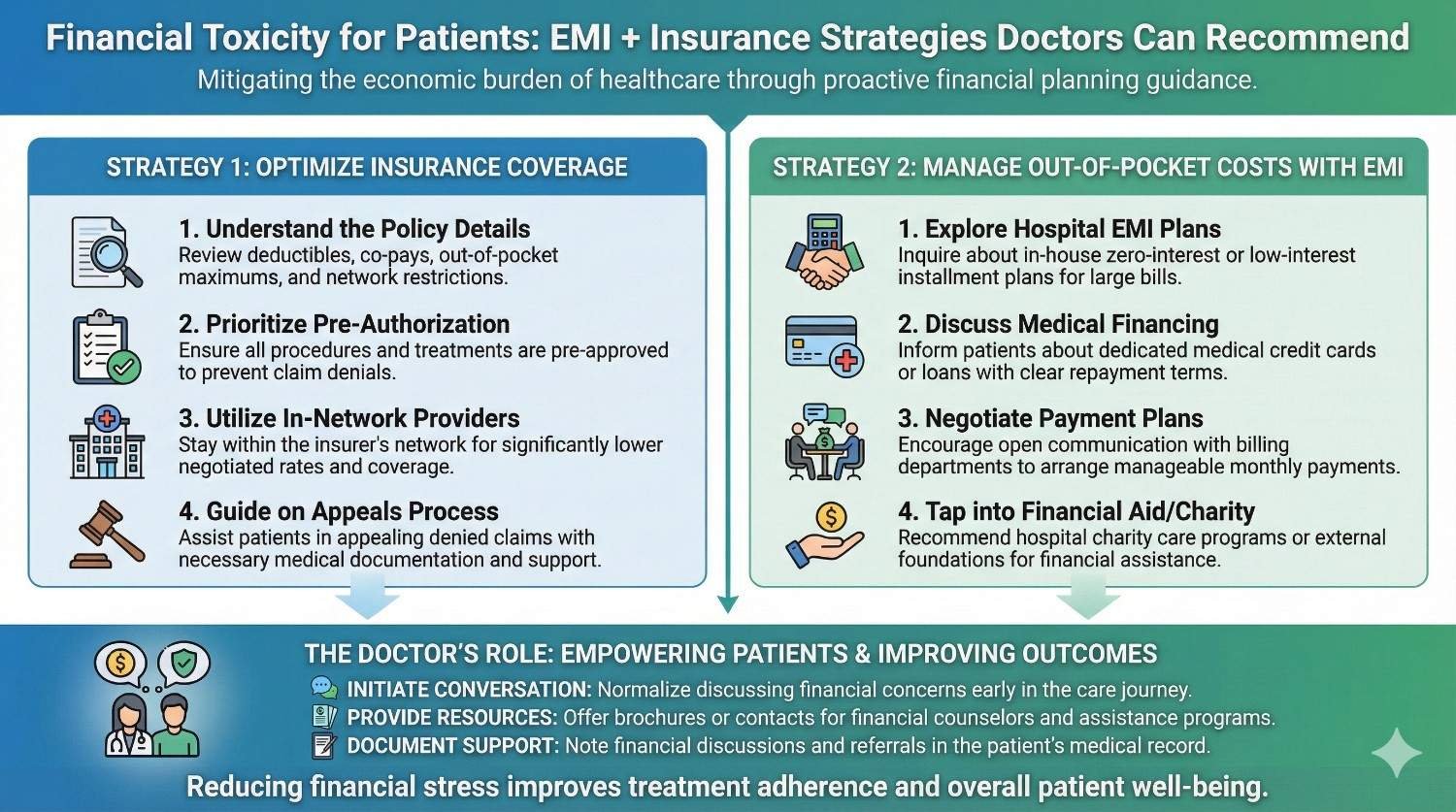

For many patients, the hardest part of prosthetic care is not surgery or rehabilitation. It is the fear of money. The cost of a prosthesis often arrives at a time when income is already disrupted, savings are thin, and the future feels uncertain. This financial stress quietly affects medical decisions, delays care, and sometimes leads patients to abandon treatment altogether. Doctors see this every day, but rarely have a clear framework to guide patients through it. This article is written to help. In simple and practical terms, it explains financial toxicity in prosthetic care and shows how doctors can responsibly guide patients using EMI options, insurance pathways, and structured planning without crossing ethical lines or becoming financial advisors.

Financial toxicity does not begin when a bill is handed over.

It often starts the moment a patient hears the word prosthesis and quietly calculates what they can afford.

Patients may nod during consultations but delay decisions later.

They ask for time, seek multiple opinions, or disappear without explanation.

This behavior is rarely about doubt in medical advice.

It is about fear of financial collapse.

When cost anxiety is high, patients choose shorter-term relief over long-term benefit.

They may opt for basic solutions that do not fit their lifestyle or work needs.

Some delay fitting even when clinically ready.

Others stretch old devices far beyond safe limits.

Doctors often see the outcome months later as complications.

By then, the original cost problem has multiplied.

Patients rarely say they are scared of debt.

Instead, they say they want to wait or manage without help.

This silence is cultural and emotional.

Many feel guilt about spending family savings on themselves.

Financial toxicity affects dignity and self-worth.

Ignoring it weakens care.

When money discussions happen late, options are fewer.

Decisions become rushed and emotional.

Early financial clarity allows planning.

Patients feel more in control and less cornered.

Doctors do not need to give numbers.

They need to open the door.

A simple acknowledgment changes everything.

It signals safety in asking questions.

Patients under money pressure skip follow-ups.

They reduce therapy sessions or avoid repairs.

These choices worsen outcomes quietly.

Doctors then face preventable failures.

Addressing financial pathways early protects treatment quality.

It supports adherence and continuity.

This is not financial counseling.

It is outcome protection.

Ignoring cost does not make care ethical.

It makes it incomplete.

Ethical care respects the patient’s full reality.

That includes financial limits.

Doctors who guide patients responsibly build trust.

Trust improves shared decision-making.

This approach strengthens professionalism.

It does not weaken it.

EMI spreads cost over time.

It does not reduce the price, but it reduces shock.

For many patients, this makes treatment possible.

Monthly payments feel manageable compared to lump sums.

EMI converts a crisis into a plan.

Planning reduces panic.

This psychological shift matters.

It affects decision quality.

Many patients believe EMI means high interest or hidden traps.

Others think it requires strong credit history.

These fears often come from past experiences.

Or from stories, not facts.

When doctors clarify that EMI is optional and transparent,

patients listen more calmly.

Clarity reduces avoidance.

It opens conversation.

EMI helps most when treatment should not be delayed.

Early fitting often improves outcomes.

It also helps when the prosthesis supports income generation.

Work-related devices justify planned payments.

Doctors should see EMI as a bridge.

Not as pressure.

The goal is access, not sales.

Intent matters.

Doctors should never lead with EMI.

They should lead with care.

After explaining the treatment plan,

they can mention that payment options exist.

A simple line works well.

“There are ways to spread cost if needed.”

This keeps choice with the patient.

It respects autonomy.

Tone is critical.

Neutral language builds trust.

Doctors should not recommend lenders.

They should not discuss interest rates.

Their role is to inform patients that options exist.

Detailed discussion can be delegated.

This boundary protects ethics.

It also protects the doctor.

Patients appreciate clarity of roles.

It reduces discomfort.

Patients often hint indirectly.

They ask about delays, cheaper alternatives, or waiting.

Doctors should recognize these signals.

They can gently ask if cost is a concern.

This question alone can relieve pressure.

Many patients feel seen.

Recognition is not intrusion.

It is care.

Insurance documents are complex.

Language is unclear and processes are slow.

Patients often do not know what is covered.

They fear rejection.

This uncertainty increases anxiety.

It delays decisions.

Doctors who understand basic pathways help immensely.

They reduce confusion.

Many policies cover surgery but not devices.

Others cap prosthetic amounts very low.

Rehab and follow-up are often excluded.

Patients learn this too late.

Doctors should know these gaps exist.

They should not assume coverage.

Awareness prevents false reassurance.

Honesty builds credibility.

Schemes may cover basic devices.

Advanced options often require co-pay.

Approval timelines can be long.

Patients need interim solutions.

Doctors should help patients plan around delays.

Not deny care.

Understanding scheme behavior matters.

It shapes guidance.

The most stable approach is layered support.

Insurance covers what it can.

EMI fills the remaining gap.

This reduces total debt.

Doctors can suggest this structure conceptually.

Details can follow later.

This approach feels logical to patients.

It lowers fear.

If EMI starts before insurance clarity,

patients may pay unnecessarily.

Doctors should encourage patients to confirm coverage early.

Timing matters.

Good sequencing reduces regret.

It improves satisfaction.

Planning beats reaction.

This applies to finances too.

Doctors can help by providing timely reports.

Delays increase patient stress.

Clear medical notes support approvals.

They speed decisions.

This is a clinical contribution.

It has financial impact.

Efficiency here matters.

It reduces emotional load.

Some patients cannot commit to monthly payments.

EMI may increase stress.

Doctors should recognize this risk.

They should not push solutions.

Alternative support or phased care may help.

Creativity matters.

The goal is sustainability.

Not just access.

Some patients consider informal loans.

These often lead to long-term harm.

Doctors should gently discourage this.

Without judging.

Encouraging formal, transparent options helps.

Safety matters.

Silence can be harmful here.

Guidance protects patients.

Even with EMI and insurance, some patients feel overwhelmed.

Doctors should normalize this feeling.

Reassurance helps.

Referrals to counseling or support groups can help.

Holistic care matters.

Financial toxicity is emotional too.

It needs empathy.

Money discussions become uncomfortable when they sound clinical or sales-like.

Doctors can keep the tone neutral by using everyday language and short explanations that focus on options, not obligations.

For example, after explaining the treatment plan, a doctor might say that costs can feel heavy and that many patients ask about spreading payments or using insurance.

This sentence does not assume need, but it opens space for the patient to respond honestly.

Neutral language lowers defensiveness.

It tells patients that money questions are normal, not embarrassing.

Many patients hesitate to raise cost concerns because they fear being judged or offered inferior care.

Doctors can remove this fear by explicitly stating that financial questions will not change the quality of medical advice.

A calm reassurance that treatment recommendations remain the same, regardless of payment method, helps patients relax.

Once that fear is gone, real conversations begin.

This approach protects ethics and trust.

It also prevents patients from quietly opting out later.

Doctors should recognize the point where detailed financial discussion no longer belongs in the consultation.

Once a patient expresses interest in EMI or insurance, the next steps should be handled by trained staff or partners.

This handoff should feel smooth and respectful.

The doctor remains the guide, not the negotiator.

Clear boundaries protect the doctor and the patient.

They also keep the consultation focused on care.

Some doctors avoid money discussions out of discomfort or fear of appearing insensitive.

This silence often harms patients more than it protects them.

When cost is not addressed, patients fill the gap with fear and assumptions.

They may delay treatment or choose unsafe alternatives.

Acknowledging cost does not cheapen care.

It completes it.

Telling patients not to worry about money without understanding their situation can backfire.

If reality later contradicts reassurance, trust is broken.

Doctors should avoid phrases that minimize cost stress.

Instead, they should acknowledge uncertainty and offer pathways.

Honest uncertainty is better than confident inaccuracy.

Patients respect realism.

Even well-meaning doctors can overemphasize EMI or insurance as solutions.

This can feel like pressure, especially to vulnerable patients.

Doctors should present options evenly.

They should allow patients time to decide.

Choice builds ownership.

Ownership improves follow-through.

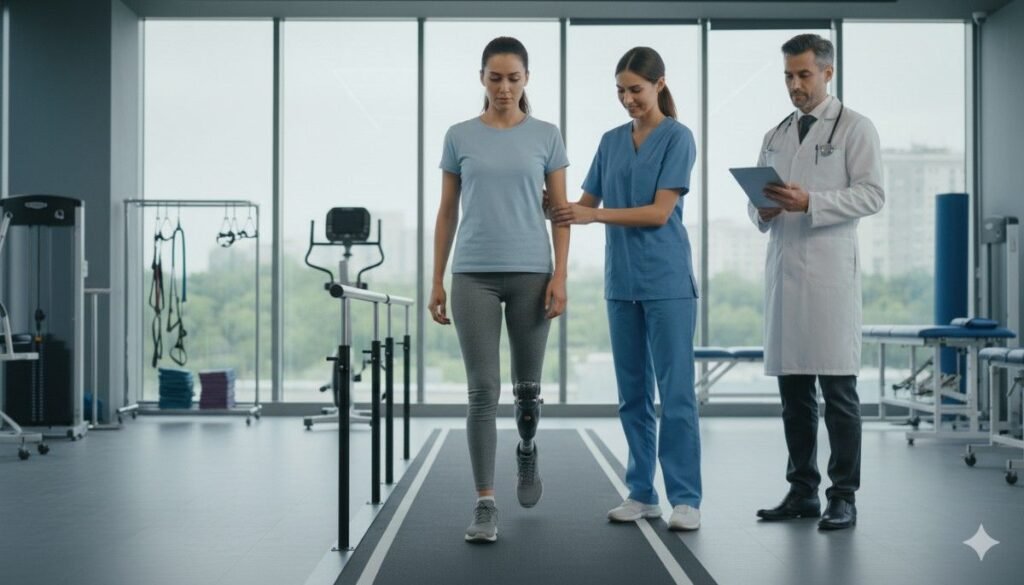

A middle-aged patient with a recent amputation may technically afford a prosthesis but fears draining family savings.

Without guidance, this patient delays fitting, hoping to “manage” with temporary solutions.

When the doctor explains EMI as a way to protect savings while regaining mobility and income, the patient reframes the decision.

The prosthesis becomes a planned investment, not a reckless expense.

Early fitting improves rehab and work return.

The financial strategy changes the clinical outcome.

A young patient covered under a family insurance policy often assumes everything will be paid for.

When partial rejection happens late, the shock is severe.

Doctors who explain early that insurance may cover only part of the cost help patients prepare emotionally and practically.

EMI then becomes a backup, not a last-minute rescue.

This sequencing reduces panic.

It preserves trust even when coverage disappoints.

Patients traveling long distances lose wages for every visit.

Lump-sum payments feel impossible when income is uncertain.

When doctors help such patients plan using small monthly payments combined with fewer but planned visits, stress reduces.

Patients adhere better because the plan feels survivable.

Financial structure supports medical adherence.

This link is often underestimated.

Doctors should never calculate EMIs, suggest lenders, or discuss interest rates.

That role belongs elsewhere.

Their role is to explain that structured options exist and that help is available.

This distinction keeps the relationship clean.

Patients trust doctors more when boundaries are clear.

It protects both sides.

Counselors, coordinators, and prosthetic centers often have the skills to handle financial logistics.

Doctors should use this support.

A simple referral within the care pathway reduces burden on the doctor.

It also ensures patients get accurate information.

Team-based care extends to finances.

It improves consistency.

A short note that payment options were discussed can be helpful.

It shows that financial aspects were considered responsibly.

This is not about liability.

It is about continuity.

If patients later feel confused, documentation helps clarify what was shared.

It supports transparency.

When patients know what to expect financially, fear reduces.

They stop avoiding calls and appointments.

Even if the cost is high, clarity allows mental preparation.

Uncertainty is often worse than reality.

Doctors who provide clarity see better engagement.

This improves outcomes quietly.

Financial toxicity often strips patients of agency.

They feel trapped between need and affordability.

Offering structured options restores choice.

Choice restores dignity.

Doctors play a key role here.

Their tone and timing matter deeply.

Patients remember how financial stress was handled.

They share these experiences with others.

Doctors who guide patients respectfully build lasting trust.

This trust extends beyond one episode of care.

Reputation is shaped here.

Often more than by technical skill.

In prosthetic care, EMI options are usually arranged through hospitals, prosthetic providers, or third-party finance partners. Patients are offered a way to divide the total payable amount into smaller monthly payments over a fixed period. The key point doctors should remember is that EMI is not a discount mechanism. It is a cash-flow tool that helps patients manage timing, not total cost.

For patients, this distinction matters psychologically. Paying a smaller amount every month feels less threatening than arranging a large sum at once, especially when income is uncertain after injury or surgery. When doctors understand this emotional relief, they can appreciate why EMI often improves treatment acceptance even when the total cost remains unchanged.

Most EMI plans range from six months to two years. Shorter tenures mean higher monthly payments but lower overall financial drag. Longer tenures reduce monthly pressure but extend the period of financial obligation, which some patients find stressful.

Doctors do not need to recommend durations, but understanding this trade-off helps them recognize patient hesitation. A patient who worries about “being stuck with payments” is not rejecting care. They are reacting to long-term uncertainty. Acknowledging this fear without judgment builds rapport and keeps the discussion constructive.

Patients are often less afraid of cost than of surprises. Hidden fees, unclear schedules, or sudden changes damage trust quickly. Doctors should reinforce the importance of clarity rather than affordability when patients discuss EMI.

By reminding patients to ask for written breakdowns and timelines, doctors help them protect themselves without getting involved in financial specifics. This simple guidance reduces future regret and reinforces ethical boundaries.

When patients receive financial information in pieces from different people, confusion grows. One person mentions insurance, another mentions EMI, and a third discusses discounts. The patient struggles to assemble a coherent picture while already under emotional strain.

Hospitals that align financial conversations into a clear pathway reduce this stress. Doctors play an important role by signaling that there is a process and that questions will be answered step by step. This reassurance alone often calms patients and improves cooperation.

The order in which financial topics are discussed matters. Insurance should always be clarified first, even if coverage is partial or uncertain. This establishes a baseline and prevents patients from committing to EMI unnecessarily.

Only after insurance limits are understood should EMI be discussed as a gap-filling option. When doctors encourage this sequence, patients feel guided rather than pushed. Planning replaces panic, and decisions become more rational.

Many prosthetic decisions involve family members who are not present during consultations. Verbal explanations may not travel accurately from patient to family, leading to conflict or delay later.

Hospitals that provide simple written summaries of options help families align faster. Doctors do not need to write these documents themselves, but they can encourage patients to ask for them. This small step reduces repeated questions and emotional friction at home.

Not all patients benefit from EMI. Those with unstable income, recent job loss, or existing heavy debt may experience increased anxiety once monthly payments begin. In such cases, EMI can deepen financial toxicity instead of reducing it.

Doctors are often the first to sense this risk through conversation. A patient who expresses fear about “not knowing what next month looks like” may not be a good candidate for long-term payment commitments. Recognizing this and slowing the process is an act of care, not obstruction.

In moments of desperation, some patients turn to informal lenders, friends of friends, or high-interest borrowing. These options often lead to long-term harm that far exceeds the cost of delayed treatment.

Doctors should gently encourage patients to avoid such routes without shaming them. Simply stating that transparent, formal options are safer than rushed borrowing can influence decisions significantly. Silence in these moments can unintentionally enable harm.

When neither EMI nor insurance fully solves the problem, phased care may be safer. This could involve starting with essential components and upgrading later when finances stabilize.

Doctors should feel comfortable discussing such phased approaches where clinically acceptable. This flexibility respects patient reality while keeping care moving forward. It reinforces that medicine can adapt without abandoning standards.

Doctors should introduce the idea that cost planning is a normal part of care, ideally before the patient asks. This removes stigma and reduces fear. A simple acknowledgment that many patients have questions about affordability is often enough to open dialogue.

Early normalization prevents last-minute distress. It also signals that the doctor is aware of the patient’s broader situation, not just the clinical problem.

Instead of assuming the issue is total cost, doctors should listen for the real concern. For some patients, it is monthly burden. For others, it is uncertainty, family pressure, or fear of debt.

Once the main fear is understood, guidance becomes more precise. EMI, insurance, or phased care can be discussed in relation to that fear rather than as generic solutions.

Doctors should consistently redirect detailed financial discussions to trained staff or systems. This protects ethics and ensures accuracy. The doctor remains the trusted guide, not the negotiator.

Patients respond well to this clarity. They feel supported without feeling sold to. This balance is crucial in high-cost care like prosthetics.

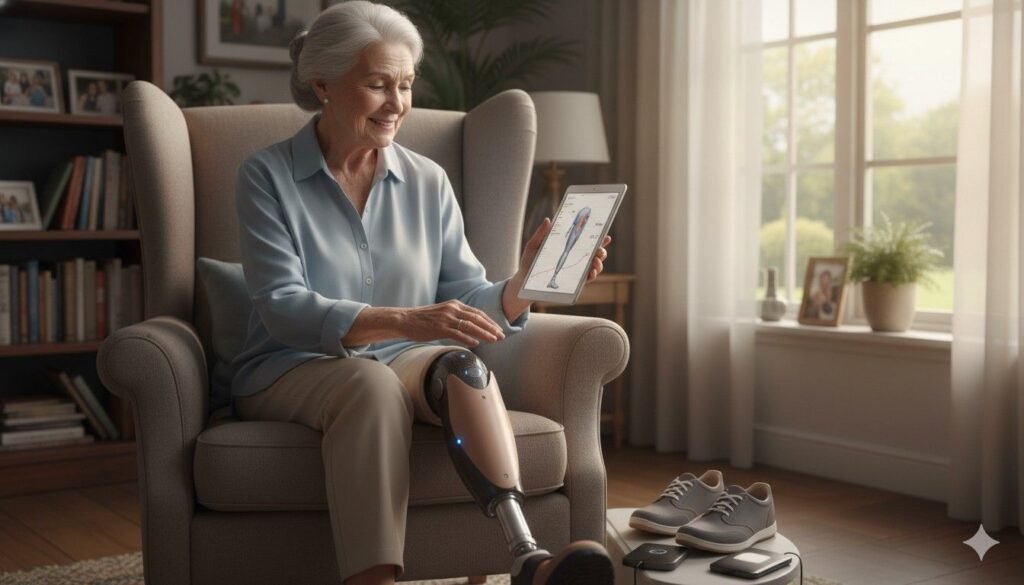

Financial stress does not end once a decision is made. Circumstances change, especially in the months after amputation or surgery. Doctors should check in briefly during follow-ups to see if financial strain is affecting adherence.

This check-in can be subtle, such as asking whether visits or therapy feel manageable. These small moments prevent silent dropouts and preserve outcomes.

When patients have a clear payment plan, they are less likely to skip visits out of fear or embarrassment. EMI structures reduce the emotional weight of each visit because the financial impact feels predictable.

Doctors often notice improved punctuality and engagement when financial uncertainty is reduced. This directly improves clinical monitoring and early problem detection.

Patients under financial strain often delay repairs or therapy sessions, hoping issues will resolve on their own. Clear payment pathways reduce this avoidance behavior.

When repairs and rehab happen on time, outcomes improve and secondary problems reduce. Financial clarity quietly supports clinical discipline.

Patients remember doctors who helped them navigate difficult financial moments with respect. This memory shapes trust and long-term loyalty.

Such relationships improve communication, reduce conflict, and make future care decisions easier. Financial guidance, when done ethically, strengthens the therapeutic alliance.

Hospitals often measure success through clinical outcomes, infection rates, or readmissions.

Affordability is rarely treated with the same seriousness, yet it shapes whether patients complete care at all.

When hospitals acknowledge financial toxicity as a quality issue, systems change.

Processes become smoother, communication improves, and fewer patients disappear mid-treatment.

This does not mean lowering standards.

It means designing care pathways that patients can realistically follow.

Hospitals that take this view see better adherence.

Clinical quality improves as a result.

One of the biggest drivers of stress is fragmented information.

Patients receive cost details from multiple people at different times, often with contradictions.

Hospitals that centralize financial navigation reduce confusion sharply.

Patients know who to speak to and what steps come next.

Doctors benefit from this clarity as well.

They can confidently reassure patients that support exists.

This structure turns chaos into a plan.

Planning reduces fear.

Financial conversations fail not because of numbers, but because of tone.

Billing desks that sound rushed or dismissive worsen anxiety.

Hospitals should train staff to recognize emotional moments.

Timing matters as much as accuracy.

When staff explain options calmly and patiently, patients feel respected.

Respect improves cooperation.

This training is not expensive.

Its impact is large.

Ethical EMI programs are built to remove barriers, not increase conversions.

They should exist to help patients start or continue care without panic.

Providers should avoid aggressive messaging around affordability.

Instead, EMI should be introduced as one of several support tools.

When EMI feels optional and transparent, patients trust it more.

Trust increases uptake naturally.

Pressure destroys credibility.

Clarity builds it.

Complex EMI structures confuse patients and families.

Variable rates, unclear schedules, or fine print increase distress.

Ethical programs prioritize predictability.

Patients should know exactly what they will pay and when.

Doctors should feel comfortable that the EMI offered is fair.

This confidence matters.

Simple terms reduce disputes later.

They also reduce dropouts.

Not every patient should be offered EMI automatically.

Providers should screen for high-risk situations such as unstable income or recent financial crisis.

In such cases, alternate approaches should be discussed.

Phased treatment, delayed upgrades, or support referrals may be safer.

These safeguards protect patients from harm.

They also protect providers from ethical conflict.

Responsible programs think beyond enrollment.

They think about outcomes.

Doctors often underestimate the impact of small statements.

A simple reassurance that payment options exist can stop a patient from mentally giving up.

This does not require detailed explanation.

It requires timing and sincerity.

Patients remember these moments.

They often describe them later as turning points.

The doctor’s voice carries authority.

Used gently, it reassures rather than pressures.

If a doctor appears uncomfortable discussing cost, patients mirror that discomfort.

If the doctor is calm and matter-of-fact, patients relax.

Tone sets the emotional frame.

Content follows.

Doctors who treat financial planning as routine reduce stigma.

This normalizes help-seeking.

Calmness is contagious.

It shapes patient behavior.

Doctors should never appear to benefit personally from financial choices.

Neutrality must be visible.

When patients sense neutrality, they trust guidance more.

They do not feel sold to.

This trust allows honest discussion of limits and options.

Honesty improves decisions.

Neutrality is an ethical asset.

It should be guarded carefully.

Financial stress is a major reason patients abandon prosthetic care.

When payment pathways are clear, abandonment drops.

Lower abandonment improves outcome statistics.

It also improves morale within care teams.

Doctors feel less frustration.

Providers see better utilization.

This creates a virtuous cycle.

Everyone benefits.

Patients talk about how they were treated during difficult moments.

Financial stress is one of those moments.

Hospitals and doctors who handle it well earn strong community trust.

This trust spreads quietly.

Reputation grows through stories, not ads.

Financial empathy fuels these stories.

Trust attracts patients who are ready to engage.

That improves outcomes further.

Healthcare systems are moving toward value-based care.

Patient adherence and long-term outcomes will matter more.

Financial toxicity directly undermines value.

Reducing it aligns hospitals with future models.

Doctors who understand this are better prepared.

They lead change rather than react to it.

Financial planning is becoming clinical relevance.

This shift is already underway.

Patients rarely reject care because they do not value it.

They reject it because they fear financial ruin.

Acknowledging this fear does not weaken authority.

It strengthens connection.

Doctors do not need to solve money problems.

They need to guide patients toward safe pathways.

This guidance protects outcomes.

It also protects dignity.

Doctors should never dismiss cost concerns or rush past them.

They should never pressure patients into commitments.

They should not give financial advice beyond their role.

Boundaries matter.

Ethical care respects limits.

Clarity preserves trust.

When in doubt, pause and refer.

That is responsible practice.

Doctors shape how patients experience care beyond medicine.

Their words influence hope, fear, and decisions.

By addressing financial toxicity with empathy and structure, doctors change trajectories.

They reduce silent suffering.

At RoboBionics, we see every day how financial clarity transforms outcomes.

Patients who feel supported engage more fully and recover better.

Financial planning is not separate from care.

It is part of healing.

For many clinicians, the surgery is only the first step. What happens after the operation

For trauma amputees, the journey does not begin at the prosthetic clinic. It begins much

Amputation after cancer is not just a surgical event. It is the end of one

When a child loses a limb, the challenge is never only physical. A child’s body

Last updated: November 10, 2022

Thank you for shopping at Robo Bionics.

If, for any reason, You are not completely satisfied with a purchase We invite You to review our policy on refunds and returns.

The following terms are applicable for any products that You purchased with Us.

The words of which the initial letter is capitalized have meanings defined under the following conditions. The following definitions shall have the same meaning regardless of whether they appear in singular or in plural.

For the purposes of this Return and Refund Policy:

Company (referred to as either “the Company”, “Robo Bionics”, “We”, “Us” or “Our” in this Agreement) refers to Bionic Hope Private Limited, Pearl Haven, 1st Floor Kumbharwada, Manickpur Near St. Michael’s Church Vasai Road West, Palghar Maharashtra 401202.

Goods refer to the items offered for sale on the Website.

Orders mean a request by You to purchase Goods from Us.

Service refers to the Services Provided like Online Demo and Live Demo.

Website refers to Robo Bionics, accessible from https://robobionics.in

You means the individual accessing or using the Service, or the company, or other legal entity on behalf of which such individual is accessing or using the Service, as applicable.

You are entitled to cancel Your Service Bookings within 7 days without giving any reason for doing so, before completion of Delivery.

The deadline for cancelling a Service Booking is 7 days from the date on which You received the Confirmation of Service.

In order to exercise Your right of cancellation, You must inform Us of your decision by means of a clear statement. You can inform us of your decision by:

We will reimburse You no later than 7 days from the day on which We receive your request for cancellation, if above criteria is met. We will use the same means of payment as You used for the Service Booking, and You will not incur any fees for such reimbursement.

Please note in case you miss a Service Booking or Re-schedule the same we shall only entertain the request once.

In order for the Goods to be eligible for a return, please make sure that:

The following Goods cannot be returned:

We reserve the right to refuse returns of any merchandise that does not meet the above return conditions in our sole discretion.

Only regular priced Goods may be refunded by 50%. Unfortunately, Goods on sale cannot be refunded. This exclusion may not apply to You if it is not permitted by applicable law.

You are responsible for the cost and risk of returning the Goods to Us. You should send the Goods at the following:

We cannot be held responsible for Goods damaged or lost in return shipment. Therefore, We recommend an insured and trackable courier service. We are unable to issue a refund without actual receipt of the Goods or proof of received return delivery.

If you have any questions about our Returns and Refunds Policy, please contact us:

Last Updated on: 1st Jan 2021

These Terms and Conditions (“Terms”) govern Your access to and use of the website, platforms, applications, products and services (ively, the “Services”) offered by Robo Bionics® (a registered trademark of Bionic Hope Private Limited, also used as a trade name), a company incorporated under the Companies Act, 2013, having its Corporate office at Pearl Heaven Bungalow, 1st Floor, Manickpur, Kumbharwada, Vasai Road (West), Palghar – 401202, Maharashtra, India (“Company”, “We”, “Us” or “Our”). By accessing or using the Services, You (each a “User”) agree to be bound by these Terms and all applicable laws and regulations. If You do not agree with any part of these Terms, You must immediately discontinue use of the Services.

1.1 “Individual Consumer” means a natural person aged eighteen (18) years or above who registers to use Our products or Services following evaluation and prescription by a Rehabilitation Council of India (“RCI”)–registered Prosthetist.

1.2 “Entity Consumer” means a corporate organisation, nonprofit entity, CSR sponsor or other registered organisation that sponsors one or more Individual Consumers to use Our products or Services.

1.3 “Clinic” means an RCI-registered Prosthetics and Orthotics centre or Prosthetist that purchases products and Services from Us for fitment to Individual Consumers.

1.4 “Platform” means RehabConnect™, Our online marketplace by which Individual or Entity Consumers connect with Clinics in their chosen locations.

1.5 “Products” means Grippy® Bionic Hand, Grippy® Mech, BrawnBand™, WeightBand™, consumables, accessories and related hardware.

1.6 “Apps” means Our clinician-facing and end-user software applications supporting Product use and data collection.

1.7 “Impact Dashboard™” means the analytics interface provided to CSR, NGO, corporate and hospital sponsors.

1.8 “Services” includes all Products, Apps, the Platform and the Impact Dashboard.

2.1 Individual Consumers must be at least eighteen (18) years old and undergo evaluation and prescription by an RCI-registered Prosthetist prior to purchase or use of any Products or Services.

2.2 Entity Consumers must be duly registered under the laws of India and may sponsor one or more Individual Consumers.

2.3 Clinics must maintain valid RCI registration and comply with all applicable clinical and professional standards.

3.1 Robo Bionics acts solely as an intermediary connecting Users with Clinics via the Platform. We do not endorse or guarantee the quality, legality or outcomes of services rendered by any Clinic. Each Clinic is solely responsible for its professional services and compliance with applicable laws and regulations.

4.1 All content, trademarks, logos, designs and software on Our website, Apps and Platform are the exclusive property of Bionic Hope Private Limited or its licensors.

4.2 Subject to these Terms, We grant You a limited, non-exclusive, non-transferable, revocable license to use the Services for personal, non-commercial purposes.

4.3 You may not reproduce, modify, distribute, decompile, reverse engineer or create derivative works of any portion of the Services without Our prior written consent.

5.1 Limited Warranty. We warrant that Products will be free from workmanship defects under normal use as follows:

(a) Grippy™ Bionic Hand, BrawnBand® and WeightBand®: one (1) year from date of purchase, covering manufacturing defects only.

(b) Chargers and batteries: six (6) months from date of purchase.

(c) Grippy Mech™: three (3) months from date of purchase.

(d) Consumables (e.g., gloves, carry bags): no warranty.

5.2 Custom Sockets. Sockets fabricated by Clinics are covered only by the Clinic’s optional warranty and subject to physiological changes (e.g., stump volume, muscle sensitivity).

5.3 Exclusions. Warranty does not apply to damage caused by misuse, user negligence, unauthorised repairs, Acts of God, or failure to follow the Instruction Manual.

5.4 Claims. To claim warranty, You must register the Product online, provide proof of purchase, and follow the procedures set out in the Warranty Card.

5.5 Disclaimer. To the maximum extent permitted by law, all other warranties, express or implied, including merchantability and fitness for a particular purpose, are disclaimed.

6.1 We collect personal contact details, physiological evaluation data, body measurements, sensor calibration values, device usage statistics and warranty information (“User Data”).

6.2 User Data is stored on secure servers of our third-party service providers and transmitted via encrypted APIs.

6.3 By using the Services, You consent to collection, storage, processing and transfer of User Data within Our internal ecosystem and to third-party service providers for analytics, R&D and support.

6.4 We implement reasonable security measures and comply with the Information Technology Act, 2000, and Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011.

6.5 A separate Privacy Policy sets out detailed information on data processing, user rights, grievance redressal and cross-border transfers, which forms part of these Terms.

7.1 Pursuant to the Information Technology Rules, 2021, We have given the Charge of Grievance Officer to our QC Head:

- Address: Grievance Officer

- Email: support@robobionics.in

- Phone: +91-8668372127

7.2 All support tickets and grievances must be submitted exclusively via the Robo Bionics Customer Support portal at https://robobionics.freshdesk.com/.

7.3 We will acknowledge receipt of your ticket within twenty-four (24) working hours and endeavour to resolve or provide a substantive response within seventy-two (72) working hours, excluding weekends and public holidays.

8.1 Pricing. Product and Service pricing is as per quotations or purchase orders agreed in writing.

8.2 Payment. We offer (a) 100% advance payment with possible incentives or (b) stage-wise payment plans without incentives.

8.3 Refunds. No refunds, except pro-rata adjustment where an Individual Consumer is medically unfit to proceed or elects to withdraw mid-stage, in which case unused stage fees apply.

9.1 Users must follow instructions provided by RCI-registered professionals and the User Manual.

9.2 Users and Entity Consumers shall indemnify and hold Us harmless from all liabilities, claims, damages and expenses arising from misuse of the Products, failure to follow professional guidance, or violation of these Terms.

10.1 To the extent permitted by law, Our total liability for any claim arising out of or in connection with these Terms or the Services shall not exceed the aggregate amount paid by You to Us in the twelve (12) months preceding the claim.

10.2 We shall not be liable for any indirect, incidental, consequential or punitive damages, including loss of profit, data or goodwill.

11.1 Our Products are classified as “Rehabilitation Aids,” not medical devices for diagnostic purposes.

11.2 Manufactured under ISO 13485:2016 quality management and tested for electrical safety under IEC 60601-1 and IEC 60601-1-2.

11.3 Products shall only be used under prescription and supervision of RCI-registered Prosthetists, Physiotherapists or Occupational Therapists.

We do not host third-party content or hardware. Any third-party services integrated with Our Apps are subject to their own terms and privacy policies.

13.1 All intellectual property rights in the Services and User Data remain with Us or our licensors.

13.2 Users grant Us a perpetual, irrevocable, royalty-free licence to use anonymised usage data for analytics, product improvement and marketing.

14.1 We may amend these Terms at any time. Material changes shall be notified to registered Users at least thirty (30) days prior to the effective date, via email and website notice.

14.2 Continued use of the Services after the effective date constitutes acceptance of the revised Terms.

Neither party shall be liable for delay or failure to perform any obligation under these Terms due to causes beyond its reasonable control, including Acts of God, pandemics, strikes, war, terrorism or government regulations.

16.1 All disputes shall be referred to and finally resolved by arbitration under the Arbitration and Conciliation Act, 1996.

16.2 A sole arbitrator shall be appointed by Bionic Hope Private Limited or, failing agreement within thirty (30) days, by the Mumbai Centre for International Arbitration.

16.3 Seat of arbitration: Mumbai, India.

16.4 Governing law: Laws of India.

16.5 Courts at Mumbai have exclusive jurisdiction over any proceedings to enforce an arbitral award.

17.1 Severability. If any provision is held invalid or unenforceable, the remainder shall remain in full force.

17.2 Waiver. No waiver of any breach shall constitute a waiver of any subsequent breach of the same or any other provision.

17.3 Assignment. You may not assign your rights or obligations without Our prior written consent.

By accessing or using the Products and/or Services of Bionic Hope Private Limited, You acknowledge that You have read, understood and agree to be bound by these Terms and Conditions.