Post-Op Follow-Up Schedule That Prevents Prosthetic Delays (For Clinicians)

For many clinicians, the surgery is only the first step. What happens after the operation

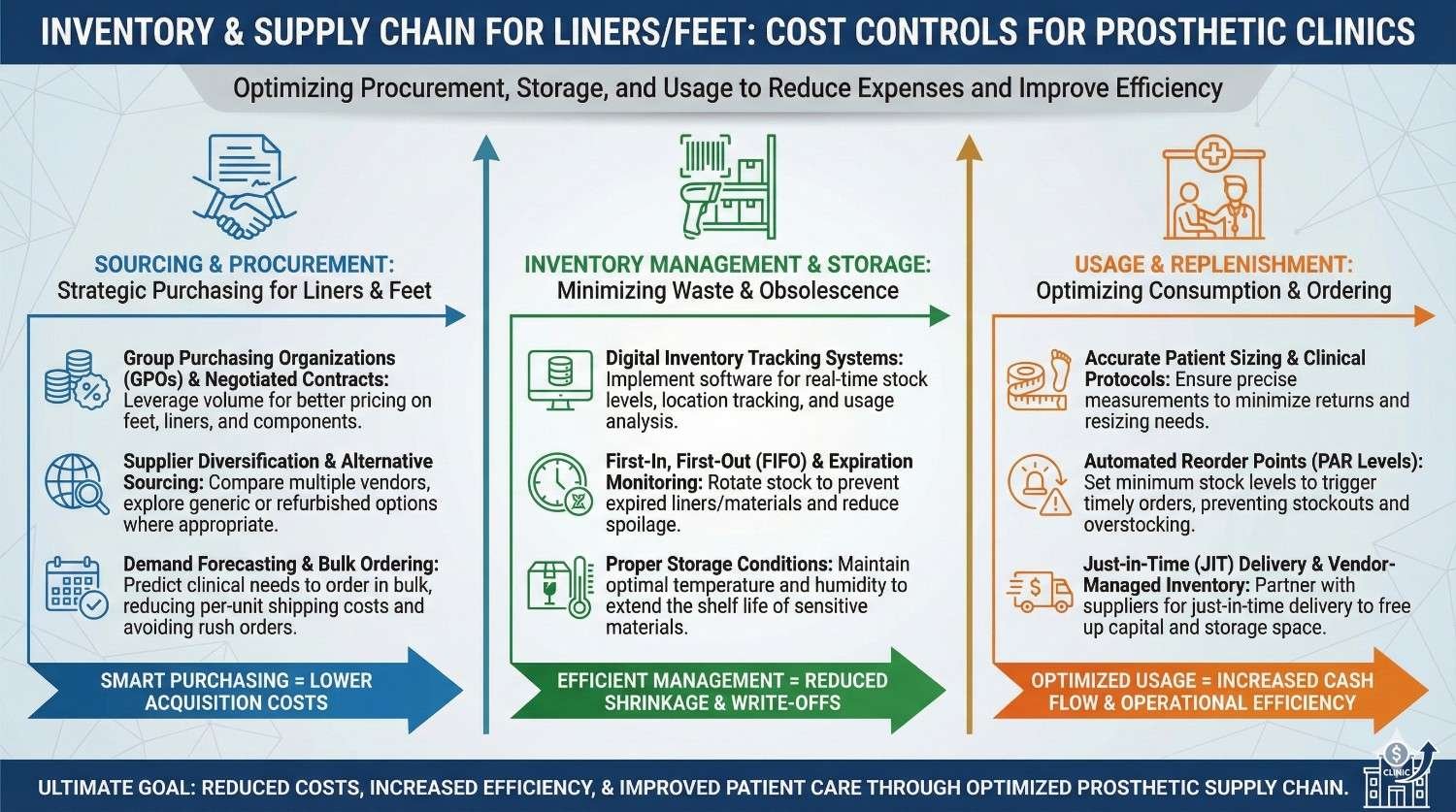

In a prosthetic clinic, money is rarely lost on big machines.

It is quietly lost on small items that move every day, like liners and prosthetic feet.

Stock that expires, sizes that do not move, urgent orders with high shipping cost, and last-minute shortages all eat into margins. Over time, these small leaks become a big problem. This article is written for clinic owners, prosthetists, and operations teams who want control, not complexity. It explains how to manage liner and foot inventory in a practical Indian setting, reduce waste, improve availability, and protect cash flow without hurting patient care.

Liners and prosthetic feet move faster than most other components in a clinic.

Because they are used daily, teams stop tracking them closely and rely on habit.

This lack of attention allows small losses to go unnoticed.

Over months, these losses quietly damage margins.

Unlike sockets or custom parts, liners and feet come in many sizes and variants.

Stocking even a “basic range” quickly multiplies inventory count.

Many of these units move slowly.

Money stays locked on shelves instead of flowing back into the clinic.

When the right liner or foot is not available, fittings get delayed.

Delays frustrate patients and disrupt schedules.

To avoid this, clinics often overstock.

Overstock then becomes waste.

Liners are not one-time items.

They wear out, stretch, tear, and need replacement.

Clinics that treat liners like permanent parts misjudge demand.

Replacement cycles must be planned, not guessed.

A liner used by a farmer wears faster than one used in an office job.

Climate, sweat, and daily hours matter.

This makes liner demand uneven and hard to predict.

Sensitivity to context improves forecasting accuracy.

Medium sizes move fast.

Very small and very large sizes move slowly.

Without size-wise tracking, dead stock builds up.

This stock rarely converts to revenue.

Prosthetic feet cost more per unit than liners.

However, they move slower.

This combination makes them risky to overstock.

One wrong purchase decision can lock cash for months.

Different clinicians prefer different foot models.

Patient needs also vary by terrain and activity.

Stocking too many models spreads demand thin.

It increases the chance of unsold inventory.

Feet can get damaged during storage or trial fittings.

Packaging is often opened prematurely.

These losses are rarely recorded properly.

They silently reduce profitability.

Many clinics feel constant cash pressure.

Revenue may look fine, but money feels tight.

Excess inventory is often the reason.

Cash is stuck in shelves, not in the bank.

Stock-outs force urgent orders.

Urgent orders cost more.

Higher shipping, smaller order sizes, and stress follow.

This repeats unless systems improve.

Staff waste time searching for items or managing shortages.

Patients sense uncertainty.

Operational stress affects care quality.

Inventory discipline improves both morale and trust.

Every liner and foot on the shelf represents cash.

This mindset shift changes behavior.

Teams become careful about what they order.

Decisions become more deliberate.

Clinics often take pride in offering many options.

In reality, most revenue comes from few items.

Tracking which items move regularly brings clarity.

Variety should follow demand, not preference.

Instant availability feels good but costs money.

Not every item needs to be on hand.

A short wait is often acceptable to patients.

Clear communication makes this possible.

Past liner replacements are the best demand signal.

They reflect real usage, not theory.

Clinics should track replacement dates by patient.

Patterns emerge quickly.

This data improves reorder timing.

It reduces both shortages and excess.

Hot months increase sweat and liner wear.

Monsoon adds hygiene challenges.

Demand often rises seasonally.

Ignoring this leads to last-minute orders.

Season-aware planning smooths operations.

It also improves patient comfort.

New fittings add future replacement demand.

This demand is delayed but predictable.

Clinics should project liner needs forward.

This avoids surprise spikes.

Planning ahead stabilizes purchasing.

It supports better supplier negotiation.

Feet demand follows new prosthetic fittings closely.

Tracking fitting numbers helps predict needs.

Clinics should separate new fits from replacements.

Each behaves differently.

This separation improves accuracy.

It avoids mixing signals.

Some clinicians consistently prescribe certain feet.

Others vary more.

Recognizing these patterns helps narrow stock.

It reduces unnecessary model variety.

Alignment discussions can help.

They support consistency without limiting care.

Demo feet often sit in inventory without clear ownership.

They blur the line between stock and tools.

Clinics should clearly label demo units.

They should not be counted as sale stock.

Clear rules reduce confusion.

They also protect revenue.

Working with many suppliers increases complexity.

Prices, lead times, and quality vary.

Fewer, trusted suppliers simplify planning.

They also enable better credit terms.

Strong relationships reduce risk.

They improve predictability.

Suppliers respond better to planned orders.

Urgent buying weakens negotiating power.

When clinics present demand forecasts, discussions change.

Prices and terms improve.

Data builds credibility.

It shifts the balance.

Weekly or biweekly deliveries reduce stock burden.

They match cash inflow better.

Clinics should negotiate delivery frequency.

This is often easier than price cuts.

Better alignment improves liquidity.

It reduces stress.

Liners degrade with heat, dust, and pressure.

Poor storage shortens shelf life.

Simple steps like clean shelves and packaging discipline help.

They reduce premature loss.

Small habits protect value.

They cost very little.

Feet should not be fully unpacked unless needed.

Trial protocols should be clear.

Uncontrolled trials lead to scratches and wear.

These units become hard to sell.

Clear rules prevent this.

They protect margins.

Audits should be frequent and light.

Annual audits are too late.

Monthly quick checks catch issues early.

They keep teams alert.

Consistency matters more than perfection.

Simple systems work best.

Many clinics avoid inventory systems fearing complexity.

In reality, even simple spreadsheets help.

Tracking size, model, and movement is enough.

Perfection is not required.

Consistency brings results.

Tools should fit the team.

Batch tracking helps with recalls and expiry control.

Barcodes reduce manual errors.

Even partial adoption improves accuracy.

It saves time long-term.

Technology should support, not burden.

Choose wisely.

Linking stock movement to billing improves visibility.

Every sale updates inventory automatically.

This reduces mismatch.

It improves financial clarity.

Integration helps decision-making.

It connects operations to outcomes.

Safety stock exists to protect clinics from uncertainty.

Unexpected fittings, delayed deliveries, or sudden liner failures can disrupt care if no buffer exists.

However, excess safety stock becomes silent waste.

The goal is balance, not comfort.

Clinics should define safety stock based on real variability.

Guesswork leads to overbuying.

Safety stock does not need complex formulas.

It starts with observing maximum weekly usage and maximum delivery delay.

If a liner size sometimes sells ten units a month and delivery can take two weeks, safety stock should cover that gap.

Anything beyond that is excess.

This simple logic prevents panic orders.

It also frees cash.

Not all items need the same buffer.

Fast-moving liners need more protection than slow-moving feet.

Clinics should avoid a one-rule approach.

Item behavior must guide stock decisions.

This differentiation reduces waste.

It improves responsiveness.

ABC analysis sorts inventory by value impact.

It does not judge clinical importance.

Category A items tie up the most money.

They need the most attention.

Category C items move fast but cost little.

They need simpler controls.

Most liner revenue comes from a few popular sizes and models.

These should be Category A or B items.

Slow-moving sizes fall into Category C.

They should be ordered cautiously.

This view helps clinics focus effort.

Not all items deserve equal time.

Feet often fall into Category A because of high unit cost.

Even low volumes can lock significant cash.

These items need tight ordering discipline.

Pre-commitment without demand is risky.

ABC analysis brings visibility.

It turns intuition into structure.

Liners do not always show visible expiry signs.

This creates false confidence.

Materials degrade over time, especially in heat.

Expired liners compromise comfort and safety.

Clinics must track expiry dates seriously.

Ignoring them risks patient trust.

FIFO is simple but powerful.

Old stock must move before new stock.

Clear shelf labeling supports this habit.

So does staff training.

Without FIFO, waste grows silently.

Discipline protects value.

Some items simply stop moving.

Ignoring them delays loss recognition.

Clinics should review dead stock quarterly.

Early decisions reduce damage.

Options include discounts, transfers, or vendor returns.

Delay only worsens outcomes.

Many vendors allow limited returns or exchanges.

Clinics often do not ask.

Clear agreements reduce risk.

They encourage smarter stocking.

Return windows should be realistic.

Terms should be documented.

Size mismatches are common with liners.

Exchange options reduce dead stock.

Clinics should prioritize vendors who support this.

Flexibility matters more than small price differences.

Over time, this saves money.

It also reduces stress.

Not all vendors perform equally.

Lead times, error rates, and support vary.

Tracking these factors helps decision-making.

Emotions should not guide purchasing.

Data-driven vendor selection improves stability.

It supports long-term growth.

When each clinic stocks independently, duplication increases.

Some locations overstock while others face shortages.

This imbalance locks cash unnecessarily.

It also frustrates staff.

Visibility across locations is key.

Without it, control is impossible.

A central hub reduces total stock required.

It allows sharing across locations.

Urgent transfers become easier.

Purchasing power improves.

Centralization supports standardization.

It simplifies training and audits.

Remote clinics may need local buffers.

Delivery delays make central-only risky.

A hybrid model often works best.

Core items centrally, fast movers locally.

Design should follow geography.

There is no one right answer.

Emergency orders usually follow poor forecasting.

They also arise from sudden clinician preference changes.

Sometimes they result from inventory blind spots.

Items were available but not visible.

Identifying root causes matters.

Fixing symptoms does not.

Low-stock alerts prevent last-minute panic.

Even manual alerts help.

Clinics should define reorder points clearly.

Waiting until zero is too late.

Early action reduces freight cost.

It improves calm.

Clinicians often do not see inventory constraints.

This gap creates tension.

Regular updates build understanding.

Shared responsibility improves outcomes.

Alignment reduces surprises.

It supports smoother care.

Inventory control is not just an admin task.

Everyone who touches stock affects outcomes.

Front desk, clinicians, and technicians all play a role.

Ignoring this spreads blame.

Training should include all roles.

Awareness builds accountability.

Recording usage immediately prevents errors.

Returning unused items promptly matters.

Clear labeling reduces confusion.

Small habits compound over time.

Discipline becomes culture.

Culture sustains systems.

Mistakes will happen.

Blame discourages reporting.

Clinics should focus on fixing systems.

Not punishing individuals.

A safe reporting culture improves accuracy.

It protects the clinic.

When clinics see how stock affects profit, behavior changes.

Inventory stops feeling abstract.

Monthly reviews help.

They connect actions to outcomes.

Visibility drives ownership.

Ownership drives control.

Inventory turnover shows how fast stock converts to cash.

Low turnover signals inefficiency.

Tracking this metric guides improvement.

It highlights problem areas.

Clinics should aim for steady improvement.

Perfection is not needed.

Buying should align with revenue patterns.

Large purchases during slow months strain cash.

Spreading orders smooths impact.

It improves stability.

Finance and operations must talk.

Silence causes stress.

Every clinic develops small tricks.

These should be documented.

A simple playbook prevents knowledge loss.

It helps new staff adapt quickly.

Consistency improves outcomes.

Documentation supports growth.

Inventory rules should evolve.

Patient mix and products change.

Quarterly reviews keep playbooks relevant.

Static rules fail over time.

Flexibility with structure is ideal.

It supports resilience.

As clinics grow, inventory complexity increases.

Early discipline pays off later.

Data-driven systems scale better.

Chaos does not.

Planning now prevents pain later.

Growth becomes manageable.

Many clinics begin with confidence that experience alone can guide inventory.

Senior prosthetists rely on memory to decide what to order, trusting intuition over numbers.

At first, this seems to work.

Then stock quietly piles up in corners, while urgent calls still happen for missing sizes.

The problem is not skill.

It is scale and repetition.

Inventory decisions made weekly need systems, not memory.

Clinics that accept this early save years of leakage.

Clinics often buy extra liners or feet “just in case.”

This decision feels patient-friendly but is financially dangerous.

Most of these items never get used within the expected time.

They either expire, become outdated, or lose relevance.

The hidden cost is opportunity.

That money could have supported growth, staff, or technology.

True patient care balances readiness with responsibility.

Excess is not safety, it is avoidance of planning.

Bulk discounts are tempting, especially for high-use items.

Clinics often buy more than needed to reduce per-unit cost.

This works only if usage matches projections.

When it does not, savings disappear.

Holding cost, expiry, and damage eat into margins.

What looked cheap becomes expensive over time.

A smaller, regular order often costs less in reality.

Total cost matters more than unit price.

One of the most common mistakes is treating all stock the same.

Demo feet, trial liners, and sale units often sit together.

Over time, demo units get sold accidentally.

Sale units get damaged during trials.

This confusion leads to write-offs and disputes.

Clear separation is essential.

Labeling and storage discipline prevent this.

They cost little but save a lot.

In many clinics, everyone orders stock and no one owns outcomes.

This leads to overlap, excess, and blame.

Inventory needs a clear owner.

Not a controller, but a coordinator.

This person tracks movement, flags risks, and aligns teams.

Ownership creates accountability.

Without it, systems fail quietly.

Clarity is non-negotiable.

Slow-moving items often get ignored.

They do not cause immediate pain.

Over time, they turn into dead stock.

At that point, recovery is difficult.

Regular review of movement highlights these items early.

Early action preserves value.

Delay always increases loss.

Time is the hidden enemy.

What feels manageable in one clinic becomes chaotic across five.

Small ordering habits multiply rapidly.

Without centralized visibility, duplication explodes.

Costs rise faster than revenue.

Growth exposes weaknesses.

It does not create them.

Clinics planning expansion must fix inventory early.

Late fixes are painful and expensive.

Standardizing liner brands, sizes, and foot models reduces complexity.

It concentrates demand.

Higher volumes of fewer items improve pricing.

They also improve availability.

Standardization does not mean rigid care.

It means controlled choice.

Clinicians should be part of this discussion.

Alignment matters.

One clinic’s excess is another’s shortage.

Without visibility, both suffer.

Internal transfer systems unlock trapped value.

They reduce emergency orders.

Even simple messaging groups can help.

Formal systems improve further.

Transfers turn inventory into a shared asset.

This mindset supports scale.

Many fear that tighter inventory means worse care.

In reality, chaos harms patients more.

Predictable stock improves scheduling.

It reduces last-minute cancellations.

Patients feel confident when clinics feel prepared.

Calm operations signal professionalism.

Cost control and care quality often move together.

They are not opposites.

Not every item can be stocked.

Patients accept short waits when informed early.

Clear communication builds trust.

Silence creates frustration.

Inventory planning enables honest timelines.

Honesty improves satisfaction.

Most patients prefer clarity over false speed.

Trust grows from truth.

Knowing liner replacement cycles helps schedule visits.

This improves care continuity.

Patients feel supported.

Clinics plan stock better.

This alignment reduces rush orders.

It also improves adherence.

Inventory data becomes a care tool.

Not just an accounting one.

Track liner sizes, models, and foot types sold monthly.

Patterns emerge quickly.

Focus attention on top movers.

Question everything else.

This clarity alone reduces waste.

It sharpens decisions.

Data replaces debate.

Action becomes easier.

Every key item should have a reorder point.

Waiting until zero is too late.

Reorder rules reduce emotion.

They replace panic with process.

Even simple rules work.

Consistency matters more than precision.

Rules free mental space.

Teams work better.

Inventory control is not set-and-forget.

Monthly reviews catch drift.

Discuss what moved, what did not, and why.

Learning improves future decisions.

This rhythm builds discipline.

Discipline sustains savings.

Small corrections prevent big losses.

Momentum builds over time.

Suppliers are part of the system.

Treat them as such.

Share forecasts and constraints.

Ask for flexibility, not favors.

Good partners help clinics grow sustainably.

Transactional relationships limit potential.

Alignment reduces surprises.

It improves margins.

Inventory is not a back-office task.

It is a strategic function.

Liners and feet may seem small, but they decide cash flow, stress levels, and patient timelines.

Ignoring them costs more than any single machine purchase.

Clinics that master inventory gain control over growth.

They protect margins without cutting care.

At RoboBionics, we work closely with clinics across India.

We see that the best-run centers are not the ones with the most stock, but the ones with the right stock.

When inventory moves with intention, clinics feel lighter, patients move faster, and teams work with confidence.

That is what real cost control looks like.

For most prosthetic clinics, inventory problems do not appear suddenly.

They build slowly, hidden inside daily routines, urgent fittings, and well-meaning decisions to “keep patients happy.”

Over time, liners expire quietly, feet sit unused, and cash feels tighter each month despite steady patient flow.

This is not a failure of care, but a failure of structure.

When clinics step back and look at liners and feet as moving money, not static items, control begins to return.

What follows is not restriction, but clarity.

Inventory discipline does not slow clinics down.

It allows them to move faster with fewer surprises.

Liners and prosthetic feet sit at the center of prosthetic delivery.

They are used often, replaced often, and expected to be instantly available.

This makes them the most dangerous items to manage casually.

Their cost impact is high precisely because they feel routine.

Clinics that control liners and feet usually control everything else more easily.

They develop habits that scale.

This focus creates a strong foundation for growth.

It turns operations from reactive to planned.

Patients may not see inventory systems, but they feel the results.

Delays, reschedules, and uncertainty all trace back to stock problems.

Clinics with predictable inventory feel calm and professional.

Patients trust them more.

Trust leads to referrals and long-term relationships.

Operational control quietly becomes a marketing advantage.

Cost control, in this sense, supports brand strength.

It is not just an internal win.

Every week, clinics should quickly review liner and foot movement.

This does not require long meetings or reports.

Ask which sizes and models moved and which did not.

This simple reflection builds awareness.

Check if any fast-moving item is close to running out.

Early action avoids panic.

These habits take minutes but save hours later.

Consistency is more important than depth.

Once a month, review slow-moving and non-moving items.

Do not postpone this step.

Identify stock older than six months.

Decide whether it should be promoted, transferred, exchanged, or written down.

Review emergency orders from the past month.

Each one is a signal that something failed upstream.

Monthly reviews prevent denial.

They turn discomfort into control.

Every quarter, review supplier performance, pricing, and lead times.

This is the right frequency for bigger decisions.

Reassess which liner brands and foot models truly deserve shelf space.

Popularity matters more than preference.

Align inventory planning with clinic growth plans.

Expansion without control multiplies problems.

Quarterly thinking keeps clinics ahead.

It replaces firefighting with foresight.

Staff should understand that inventory control supports patient care.

It is not about cutting corners.

When stock is planned, fittings happen on time.

When fittings happen on time, outcomes improve.

This connection should be stated clearly.

People protect what they understand.

Inventory is not separate from care.

It enables care.

Teams should feel safe asking before ordering.

Assumptions are expensive.

Encourage discussion around unusual orders.

Most errors start with silence.

A questioning culture reduces waste.

It improves learning.

Curiosity saves money.

Defensiveness costs it.

Human memory fades and biases grow.

Data stays honest.

Even simple tracking beats experience alone.

Over time, data sharpens intuition.

Clinics that trust numbers argue less and decide faster.

This improves morale.

Data does not replace people.

It supports them.

At RoboBionics, we work with clinics across different sizes, regions, and patient mixes.

We see how inventory pain points repeat, regardless of scale.

We support clinics with predictable supply, transparent lead times, and realistic guidance on what truly moves.

We also help clinics avoid overbuying by aligning supply with actual prescription patterns.

Our goal is not to push volume.

It is to support sustainable growth.

When clinics succeed operationally, patients benefit.

That alignment is core to our approach.

Inventory control is not about becoming rigid.

It is about becoming intentional.

Liners and prosthetic feet may seem small, but they decide how smoothly a clinic runs, how stable cash flow feels, and how confident teams remain under pressure.

Ignoring them is costly.

Clinics that master inventory do not just save money.

They gain calm, clarity, and control.

In a field built around restoring movement and independence, operational stability matters deeply.

Strong systems allow clinicians to focus on what truly matters: patients.

For many clinicians, the surgery is only the first step. What happens after the operation

For trauma amputees, the journey does not begin at the prosthetic clinic. It begins much

Amputation after cancer is not just a surgical event. It is the end of one

When a child loses a limb, the challenge is never only physical. A child’s body

Last updated: November 10, 2022

Thank you for shopping at Robo Bionics.

If, for any reason, You are not completely satisfied with a purchase We invite You to review our policy on refunds and returns.

The following terms are applicable for any products that You purchased with Us.

The words of which the initial letter is capitalized have meanings defined under the following conditions. The following definitions shall have the same meaning regardless of whether they appear in singular or in plural.

For the purposes of this Return and Refund Policy:

Company (referred to as either “the Company”, “Robo Bionics”, “We”, “Us” or “Our” in this Agreement) refers to Bionic Hope Private Limited, Pearl Haven, 1st Floor Kumbharwada, Manickpur Near St. Michael’s Church Vasai Road West, Palghar Maharashtra 401202.

Goods refer to the items offered for sale on the Website.

Orders mean a request by You to purchase Goods from Us.

Service refers to the Services Provided like Online Demo and Live Demo.

Website refers to Robo Bionics, accessible from https://robobionics.in

You means the individual accessing or using the Service, or the company, or other legal entity on behalf of which such individual is accessing or using the Service, as applicable.

You are entitled to cancel Your Service Bookings within 7 days without giving any reason for doing so, before completion of Delivery.

The deadline for cancelling a Service Booking is 7 days from the date on which You received the Confirmation of Service.

In order to exercise Your right of cancellation, You must inform Us of your decision by means of a clear statement. You can inform us of your decision by:

We will reimburse You no later than 7 days from the day on which We receive your request for cancellation, if above criteria is met. We will use the same means of payment as You used for the Service Booking, and You will not incur any fees for such reimbursement.

Please note in case you miss a Service Booking or Re-schedule the same we shall only entertain the request once.

In order for the Goods to be eligible for a return, please make sure that:

The following Goods cannot be returned:

We reserve the right to refuse returns of any merchandise that does not meet the above return conditions in our sole discretion.

Only regular priced Goods may be refunded by 50%. Unfortunately, Goods on sale cannot be refunded. This exclusion may not apply to You if it is not permitted by applicable law.

You are responsible for the cost and risk of returning the Goods to Us. You should send the Goods at the following:

We cannot be held responsible for Goods damaged or lost in return shipment. Therefore, We recommend an insured and trackable courier service. We are unable to issue a refund without actual receipt of the Goods or proof of received return delivery.

If you have any questions about our Returns and Refunds Policy, please contact us:

Last Updated on: 1st Jan 2021

These Terms and Conditions (“Terms”) govern Your access to and use of the website, platforms, applications, products and services (ively, the “Services”) offered by Robo Bionics® (a registered trademark of Bionic Hope Private Limited, also used as a trade name), a company incorporated under the Companies Act, 2013, having its Corporate office at Pearl Heaven Bungalow, 1st Floor, Manickpur, Kumbharwada, Vasai Road (West), Palghar – 401202, Maharashtra, India (“Company”, “We”, “Us” or “Our”). By accessing or using the Services, You (each a “User”) agree to be bound by these Terms and all applicable laws and regulations. If You do not agree with any part of these Terms, You must immediately discontinue use of the Services.

1.1 “Individual Consumer” means a natural person aged eighteen (18) years or above who registers to use Our products or Services following evaluation and prescription by a Rehabilitation Council of India (“RCI”)–registered Prosthetist.

1.2 “Entity Consumer” means a corporate organisation, nonprofit entity, CSR sponsor or other registered organisation that sponsors one or more Individual Consumers to use Our products or Services.

1.3 “Clinic” means an RCI-registered Prosthetics and Orthotics centre or Prosthetist that purchases products and Services from Us for fitment to Individual Consumers.

1.4 “Platform” means RehabConnect™, Our online marketplace by which Individual or Entity Consumers connect with Clinics in their chosen locations.

1.5 “Products” means Grippy® Bionic Hand, Grippy® Mech, BrawnBand™, WeightBand™, consumables, accessories and related hardware.

1.6 “Apps” means Our clinician-facing and end-user software applications supporting Product use and data collection.

1.7 “Impact Dashboard™” means the analytics interface provided to CSR, NGO, corporate and hospital sponsors.

1.8 “Services” includes all Products, Apps, the Platform and the Impact Dashboard.

2.1 Individual Consumers must be at least eighteen (18) years old and undergo evaluation and prescription by an RCI-registered Prosthetist prior to purchase or use of any Products or Services.

2.2 Entity Consumers must be duly registered under the laws of India and may sponsor one or more Individual Consumers.

2.3 Clinics must maintain valid RCI registration and comply with all applicable clinical and professional standards.

3.1 Robo Bionics acts solely as an intermediary connecting Users with Clinics via the Platform. We do not endorse or guarantee the quality, legality or outcomes of services rendered by any Clinic. Each Clinic is solely responsible for its professional services and compliance with applicable laws and regulations.

4.1 All content, trademarks, logos, designs and software on Our website, Apps and Platform are the exclusive property of Bionic Hope Private Limited or its licensors.

4.2 Subject to these Terms, We grant You a limited, non-exclusive, non-transferable, revocable license to use the Services for personal, non-commercial purposes.

4.3 You may not reproduce, modify, distribute, decompile, reverse engineer or create derivative works of any portion of the Services without Our prior written consent.

5.1 Limited Warranty. We warrant that Products will be free from workmanship defects under normal use as follows:

(a) Grippy™ Bionic Hand, BrawnBand® and WeightBand®: one (1) year from date of purchase, covering manufacturing defects only.

(b) Chargers and batteries: six (6) months from date of purchase.

(c) Grippy Mech™: three (3) months from date of purchase.

(d) Consumables (e.g., gloves, carry bags): no warranty.

5.2 Custom Sockets. Sockets fabricated by Clinics are covered only by the Clinic’s optional warranty and subject to physiological changes (e.g., stump volume, muscle sensitivity).

5.3 Exclusions. Warranty does not apply to damage caused by misuse, user negligence, unauthorised repairs, Acts of God, or failure to follow the Instruction Manual.

5.4 Claims. To claim warranty, You must register the Product online, provide proof of purchase, and follow the procedures set out in the Warranty Card.

5.5 Disclaimer. To the maximum extent permitted by law, all other warranties, express or implied, including merchantability and fitness for a particular purpose, are disclaimed.

6.1 We collect personal contact details, physiological evaluation data, body measurements, sensor calibration values, device usage statistics and warranty information (“User Data”).

6.2 User Data is stored on secure servers of our third-party service providers and transmitted via encrypted APIs.

6.3 By using the Services, You consent to collection, storage, processing and transfer of User Data within Our internal ecosystem and to third-party service providers for analytics, R&D and support.

6.4 We implement reasonable security measures and comply with the Information Technology Act, 2000, and Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011.

6.5 A separate Privacy Policy sets out detailed information on data processing, user rights, grievance redressal and cross-border transfers, which forms part of these Terms.

7.1 Pursuant to the Information Technology Rules, 2021, We have given the Charge of Grievance Officer to our QC Head:

- Address: Grievance Officer

- Email: support@robobionics.in

- Phone: +91-8668372127

7.2 All support tickets and grievances must be submitted exclusively via the Robo Bionics Customer Support portal at https://robobionics.freshdesk.com/.

7.3 We will acknowledge receipt of your ticket within twenty-four (24) working hours and endeavour to resolve or provide a substantive response within seventy-two (72) working hours, excluding weekends and public holidays.

8.1 Pricing. Product and Service pricing is as per quotations or purchase orders agreed in writing.

8.2 Payment. We offer (a) 100% advance payment with possible incentives or (b) stage-wise payment plans without incentives.

8.3 Refunds. No refunds, except pro-rata adjustment where an Individual Consumer is medically unfit to proceed or elects to withdraw mid-stage, in which case unused stage fees apply.

9.1 Users must follow instructions provided by RCI-registered professionals and the User Manual.

9.2 Users and Entity Consumers shall indemnify and hold Us harmless from all liabilities, claims, damages and expenses arising from misuse of the Products, failure to follow professional guidance, or violation of these Terms.

10.1 To the extent permitted by law, Our total liability for any claim arising out of or in connection with these Terms or the Services shall not exceed the aggregate amount paid by You to Us in the twelve (12) months preceding the claim.

10.2 We shall not be liable for any indirect, incidental, consequential or punitive damages, including loss of profit, data or goodwill.

11.1 Our Products are classified as “Rehabilitation Aids,” not medical devices for diagnostic purposes.

11.2 Manufactured under ISO 13485:2016 quality management and tested for electrical safety under IEC 60601-1 and IEC 60601-1-2.

11.3 Products shall only be used under prescription and supervision of RCI-registered Prosthetists, Physiotherapists or Occupational Therapists.

We do not host third-party content or hardware. Any third-party services integrated with Our Apps are subject to their own terms and privacy policies.

13.1 All intellectual property rights in the Services and User Data remain with Us or our licensors.

13.2 Users grant Us a perpetual, irrevocable, royalty-free licence to use anonymised usage data for analytics, product improvement and marketing.

14.1 We may amend these Terms at any time. Material changes shall be notified to registered Users at least thirty (30) days prior to the effective date, via email and website notice.

14.2 Continued use of the Services after the effective date constitutes acceptance of the revised Terms.

Neither party shall be liable for delay or failure to perform any obligation under these Terms due to causes beyond its reasonable control, including Acts of God, pandemics, strikes, war, terrorism or government regulations.

16.1 All disputes shall be referred to and finally resolved by arbitration under the Arbitration and Conciliation Act, 1996.

16.2 A sole arbitrator shall be appointed by Bionic Hope Private Limited or, failing agreement within thirty (30) days, by the Mumbai Centre for International Arbitration.

16.3 Seat of arbitration: Mumbai, India.

16.4 Governing law: Laws of India.

16.5 Courts at Mumbai have exclusive jurisdiction over any proceedings to enforce an arbitral award.

17.1 Severability. If any provision is held invalid or unenforceable, the remainder shall remain in full force.

17.2 Waiver. No waiver of any breach shall constitute a waiver of any subsequent breach of the same or any other provision.

17.3 Assignment. You may not assign your rights or obligations without Our prior written consent.

By accessing or using the Products and/or Services of Bionic Hope Private Limited, You acknowledge that You have read, understood and agree to be bound by these Terms and Conditions.