Post-Op Follow-Up Schedule That Prevents Prosthetic Delays (For Clinicians)

For many clinicians, the surgery is only the first step. What happens after the operation

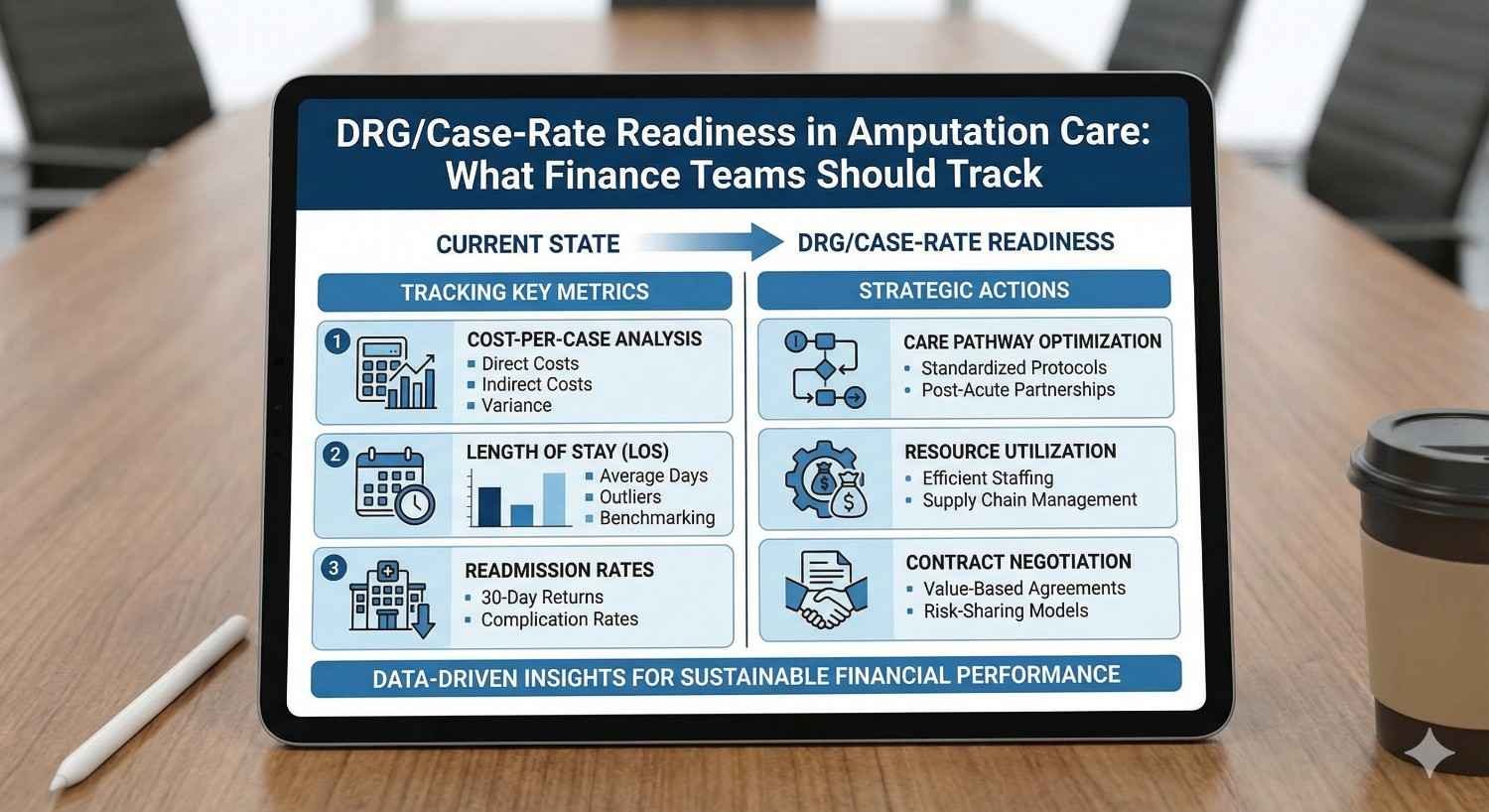

Payment models in healthcare are shifting steadily toward fixed rates, bundled payments, and DRG-based reimbursement. In amputation care, this shift changes everything for finance teams. Costs that were once passed through line by line now sit inside a single case rate, making variation, delays, and complications far more expensive than before.

This article looks at DRG and case-rate readiness specifically for amputation care, written for hospital finance and operations teams. It explains what really drives margin under fixed payment models, which cost signals matter most, and how better tracking can turn amputation episodes from financial risk into predictable, well-managed care pathways.

Under fee-for-service models, every additional day, visit, or procedure could be billed. DRG and case-rate models change that logic completely. The hospital now receives a fixed amount for the entire amputation episode, regardless of how long care takes or how many resources are used.

For finance teams, this means responsibility shifts inward. Delays, complications, and inefficiencies no longer increase revenue. They reduce margin. What once felt like clinical variation now becomes financial risk.

Understanding this shift is the first step toward readiness.

Amputation care is not a single event. It includes surgery, inpatient recovery, wound management, rehabilitation, prosthetic planning, and follow-up. Each stage has the potential to run longer than expected.

Under a case rate, all of this activity sits inside one payment envelope. If any part of the pathway stretches, the entire episode becomes less profitable. This makes amputation care one of the more complex services to manage under DRGs.

Finance teams must therefore look beyond surgery costs alone.

DRG models reward predictability. The closer actual cost stays to expected cost, the safer margins become. In amputation care, variation is common due to infection, slow healing, social factors, and delayed prosthetic planning.

Each variation adds days, visits, and staff time. Under DRGs, these additions are not reimbursed. Tracking and reducing variation becomes a core financial strategy, not just a quality goal.

Many finance dashboards focus heavily on surgical cost. While important, surgery is often not the largest driver of total episode spend.

Post-operative care, wound management, antibiotics, imaging, and inpatient stay frequently outweigh the operating room cost. Under DRGs, these downstream elements often determine profitability more than the surgery itself.

Finance teams must widen their lens to see the full episode.

In amputation care, length of stay is one of the strongest predictors of margin erosion. Each additional inpatient day brings nursing cost, bed occupancy, medications, and overhead.

DRG payments rarely adjust for longer stays unless strict outlier criteria are met. This means even small increases in average length of stay can significantly affect financial performance.

Tracking length of stay by amputation type and cause is essential.

Rehabilitation costs are sometimes managed by separate departments or external partners. Under bundled or case-rate models, these costs still affect the hospital’s total financial exposure.

If rehab takes longer due to delayed mobility or poor coordination, the financial impact may show up later, but it still matters. Finance teams need visibility across acute and post-acute phases to truly understand episode cost.

Not all amputations cost the same. Above-knee amputations, diabetic cases, and oncology-related amputations have very different cost profiles.

DRG reimbursement may not fully reflect this variation. Finance teams should track cost and margin by amputation type, not just in aggregate.

This helps identify which cases are consistently underperforming financially.

Trauma, diabetes, vascular disease, and cancer each create different care pathways. Diabetic amputations often involve infection and longer healing. Oncology cases may involve coordination with chemotherapy.

Tracking cost by cause reveals patterns that DRG averages often hide. These insights allow better clinical and financial planning.

Complications are expensive under any model, but under DRGs they are especially damaging. Infections, wound breakdown, and reoperations quickly consume margin.

Finance teams should track complication rates alongside cost, not separately. The financial penalty of each complication should be understood clearly.

This turns prevention into a measurable financial priority.

When prosthetic planning starts late, patients remain immobile longer. This extends inpatient stay and increases rehab intensity.

Under DRGs, these delays are rarely reimbursed. What feels like a clinical scheduling issue becomes a financial drain.

Early prosthetic involvement often shortens recovery timelines and protects margin.

Even limited early mobility can reduce length of stay. Temporary or preparatory prosthetics allow earlier transfers and safer movement.

Finance teams should understand how early mobility affects bed days. Small investments in early prosthetic integration often yield large savings.

This is one of the most overlooked levers in DRG readiness.

If patients abandon prosthetic use due to poor fit or delayed support, long-term outcomes worsen. Readmissions and repeat care increase.

While some of these costs may fall outside the initial DRG window, they affect overall system performance and payer relationships.

Sustained prosthetic use is both a clinical and financial goal.

Not all inpatient days are equal. Some are clinically necessary. Others result from delays in coordination, decision-making, or discharge planning.

Finance teams should work with clinical leaders to identify avoidable bed days. These days often cluster around wound checks, therapy scheduling, or prosthetic consult delays.

Removing these delays improves both care flow and financial performance.

Clinical pathways should reflect expected length of stay under DRG payment. When pathways drift, cost increases silently.

Finance teams can support alignment by sharing data on expected versus actual stay. Data-driven conversations reduce defensiveness and improve collaboration.

Alignment protects margin without reducing care quality.

Discharge planning should begin early in the admission. Late planning often leads to unnecessary extra days.

Finance teams should view early discharge planning as a cost-control strategy, not just a social service function.

Early planning reduces last-minute delays and bed blocking.

In many systems, readmissions are not reimbursed separately or are penalized. This makes them pure cost.

Amputation patients are at high risk for readmission due to wound issues and falls. Each readmission erodes margin and damages quality metrics.

Tracking readmission causes is essential for DRG readiness.

Many readmissions are driven by decisions made during the initial stay. Poor wound education, delayed prosthetic fitting, or rushed discharge all contribute.

Finance teams should work backward from readmissions to identify upstream cost drivers.

Prevention is cheaper than absorbing repeat admissions.

Structured follow-up reduces readmission risk. While follow-up has a cost, it is far lower than inpatient readmission.

Finance teams should support investments in follow-up as margin protection, not overhead.

This shift in thinking is critical under DRGs.

DRG assignment relies heavily on accurate coding. Missed comorbidities or complications can lead to underpayment.

Amputation patients often have multiple conditions that must be documented clearly. Finance teams should ensure coding teams are trained specifically for amputation cases.

Better documentation improves revenue accuracy.

Clinicians document for care, not payment. This can lead to gaps that affect DRG classification.

Finance teams can support education that helps clinicians understand how documentation affects reimbursement, without adding burden.

Alignment improves both compliance and margin.

If average reimbursement per amputation case declines, it may signal coding issues rather than true payer changes.

Regular review of DRG trends helps catch problems early.

Early correction prevents long-term revenue loss.

Payers are moving steadily toward fixed payments. Variability is being squeezed out of reimbursement models.

Hospitals that do not adapt will see margins erode over time, even if volumes remain stable.

DRG readiness is not optional. It is a survival skill.

Predictable pathways reduce cost variation. This makes DRG performance more stable.

Finance teams should support pathway standardization while allowing clinical judgment where needed.

Balance is key to sustainable performance.

Dashboards that track length of stay, complications, prosthetic timing, and readmissions provide early signals.

Finance teams should not wait for end-of-year results to act. Continuous monitoring enables course correction.

Proactive management beats retrospective analysis.

Traditional monthly reports arrive too late to change outcomes. Under DRG and case-rate models, finance teams need live or near-real-time visibility into how amputation cases are progressing.

Living dashboards allow teams to see where cost is building while the patient is still in care. This makes it possible to intervene early, rather than explaining losses later.

The goal is not more data, but timely data that guides action.

Every amputation type should have an expected length of stay range based on historical data and DRG norms. Dashboards should clearly show when a case crosses that expected range.

When a stay extends beyond expectation, the question should not be blame. It should be why. Is it wound healing, delayed rehab, social issues, or coordination gaps?

Clear visibility turns length of stay from a surprise into a managed variable.

Prosthetic consult timing, first standing, and first assisted walk are not just clinical milestones. They are financial indicators under DRGs.

Dashboards that track when prosthetic teams are involved help finance teams understand whether recovery is on track. Delays here often predict longer stays and higher rehab cost.

Seeing these signals early allows corrective action that protects margin.

In fee-for-service systems, departments could operate independently without immediate financial impact. Under DRGs, silos become expensive.

When surgery, rehab, prosthetics, and discharge planning do not align, delays accumulate. Each delay adds cost that cannot be billed.

Finance teams play a key role in breaking silos by sharing data that shows system-level impact.

Data should be used to support collaboration, not policing. When finance teams bring neutral data on length of stay, delays, or readmissions, discussions become problem-solving sessions rather than conflicts.

For example, showing that delayed rehab assessment adds two inpatient days across many cases creates shared urgency.

Data changes the tone from opinion to evidence.

Under DRGs, no single department owns the full financial outcome. The episode does. Hospitals that assign shared ownership for amputation pathways perform better financially.

Finance teams can support this by framing discussions around episode performance rather than departmental spend.

Shared ownership aligns incentives naturally.

Not all variation is bad. Some patients genuinely need longer care due to infection, poor circulation, or complex social needs.

The financial problem arises when variation is avoidable. Delayed decisions, repeated assessments, or lack of coordination create variation that adds no value.

Finance teams should help identify which variation is expected and which is preventable.

Standard amputation care pathways act as guardrails, not rigid rules. They set expected timelines and milestones while allowing clinicians to deviate when needed.

Under DRGs, these pathways protect margin by reducing unnecessary drift. Finance teams should support pathway development with cost and outcome data.

Well-designed pathways balance efficiency with safety.

Cost control without outcome tracking creates resistance. Clinicians worry about being pushed to discharge too early.

Finance teams should always pair cost data with outcome data such as readmissions, wound healing, and mobility.

When outcomes remain strong, efficiency gains are easier to accept.

Rehabilitation often extends beyond the acute stay, but its planning affects inpatient cost. Delayed or inefficient rehab increases length of stay.

Finance teams should track time to rehab assessment and therapy intensity. Early, focused rehab often shortens total care duration.

Rehab is not a cost center alone. It is a cost control lever.

Discharge to home, rehab facility, or step-down care has major cost implications. Under DRGs, poor discharge matching leads to readmissions or prolonged stays.

Finance teams should support discharge planning with data on outcomes by setting.

Right placement reduces total episode cost.

If prosthetic fitting and training are not coordinated with rehab, patients stall. Stalls increase therapy days and risk readmission.

Finance teams should encourage coordination across acute and post-acute phases.

Continuity protects both outcomes and margins.

Not all readmissions are equal. Early readmissions within days of discharge often reflect gaps in initial care.

Finance teams should track readmission timing and cause. Patterns usually point to specific upstream issues.

Targeted prevention is more effective than broad restrictions.

Follow-up calls, early clinic visits, and wound checks cost money, but far less than a readmission.

Under DRGs, these services act as insurance against large losses. Finance teams should view them as protective investments.

Prevention stabilizes financial performance.

Each readmission should trigger pathway review, not just clinical review. What step failed? Education, equipment, rehab, or timing?

Finance involvement ensures financial lessons are learned alongside clinical ones.

Learning reduces repeat loss.

Amputation patients often have diabetes, vascular disease, infection, and other conditions that affect DRG assignment.

If these are not documented clearly, reimbursement may be lower than appropriate. Under DRGs, this loss cannot be recovered later.

Finance teams must ensure strong clinical documentation support.

Clinicians do not need coding manuals. They need simple guidance on what details matter.

Short, focused education on documenting comorbidities and complications can significantly improve DRG accuracy.

Better documentation protects revenue without changing care.

Coding patterns change over time. Staff turnover and system updates can introduce errors.

Regular audits of amputation DRGs help catch underpayment early.

Early correction prevents long-term leakage.

Payers refine DRGs continuously. As data improves, reimbursement becomes more precise and often more restrictive.

Hospitals that rely on absorbing variation will struggle. Those that manage variation proactively will survive.

Preparation must start before pressure increases.

Under DRGs, finance teams are no longer just reporting units. They are strategic partners in care design.

Their insight into cost patterns shapes pathways, staffing, and investment decisions.

This role requires confidence and collaboration.

The discipline required for DRG success often improves care quality. Reduced delays, better coordination, and clearer pathways benefit patients.

Financial discipline and clinical excellence can reinforce each other.

This alignment is the real opportunity.

One of the most common mistakes is viewing amputation as a surgical event rather than a full episode of care. When finance teams focus only on operating room cost, they miss where most DRG losses actually occur.

The majority of cost creep happens after surgery, during inpatient recovery, wound care, rehabilitation, and discharge delays. Ignoring these phases leaves finance teams reacting to losses instead of managing them.

DRG success depends on managing the entire journey, not just the incision.

Averages hide risk. An average length of stay may look acceptable while a small group of cases creates most of the losses.

Finance teams that rely only on averages miss recurring patterns, such as diabetic amputations with delayed healing or oncology cases with late prosthetic planning. These patterns are where margin is lost repeatedly.

Pattern recognition is more valuable than summary statistics.

Some finance teams try to control cost only through budget caps or utilization limits. This approach often creates tension and does not address root causes.

Under DRGs, cost control works best when finance teams engage in care design discussions. Improving coordination, timing, and pathways reduces cost without limiting care.

Process improvement beats restriction every time.

Tracking spend by department is not enough under DRGs. Finance teams must track total cost per amputation episode from admission to discharge and early follow-up.

This episode view reveals how costs shift across departments and where delays create compound expense. Without this view, decisions are made in fragments.

DRGs reward systems thinking, not silo accounting.

Different amputations behave differently. Above-knee cases, diabetic infections, and cancer-related amputations each carry distinct length-of-stay risks.

Finance teams should track length of stay by type and cause, not as a single average. This allows realistic benchmarking and better pathway design.

Precision improves predictability.

Certain milestones predict whether a case will stay within DRG targets. Time to wound stabilization, time to rehab assessment, and time to first mobilization are especially important.

When these milestones slip, cost almost always follows. Tracking them gives finance teams early warning signals.

Early signals allow early correction.

Readmissions should not be tracked as isolated failures. They must be linked back to decisions made during the original admission.

Finance teams should ask whether readmissions are driven by early discharge, poor education, delayed prosthetics, or weak follow-up. This linkage turns readmissions into learning opportunities.

Learning reduces repeat loss.

Finance teams often face resistance when discussions sound like cost-cutting exercises. Framing conversations around stability, predictability, and reduced chaos changes the tone.

Clinicians also want fewer delays, fewer complications, and smoother care. DRG readiness aligns with these goals when discussed correctly.

Shared goals reduce defensiveness.

Discussing individual cases where cost escalated due to delays or coordination gaps is more effective than broad pressure to reduce spend.

Case reviews feel concrete and fair. They highlight real barriers rather than abstract targets.

Specific examples drive meaningful change.

Not every case should fit a standard pathway. Finance teams must acknowledge this openly.

The goal is not zero variation, but controlled variation. When deviation is intentional and documented, it is easier to accept financially.

Respect builds trust, and trust enables collaboration.

Early prosthetic involvement reduces immobility, speeds rehab, and shortens length of stay. Under DRGs, this timing decision has major financial impact.

Finance teams should view early prosthetic planning as a cost-control investment, not an added expense. The return often comes through reduced bed days.

Few investments have such clear impact.

Dedicated coordinators for amputation pathways reduce delays between surgery, rehab, prosthetics, and discharge planning.

While coordination roles have a cost, they often prevent multiple inpatient days across many cases. The savings outweigh the salary.

Coordination is one of the highest ROI roles under DRGs.

Dashboards and reporting tools require upfront effort. However, without real-time data, finance teams are always reacting too late.

Investment in data visibility allows proactive management of cases while outcomes can still change.

Timely data protects margin.

Know your average length of stay, complication rate, readmission rate, and episode cost by amputation type. Without a baseline, improvement is guesswork.

Baseline clarity is the foundation of readiness.

Identify which patient groups consistently exceed DRG targets. These often include diabetic infections, vascular disease, and socially complex cases.

Targeted pathway improvements deliver faster results than broad efforts.

Ensure clinical pathways reflect realistic DRG expectations, including rehab timing and discharge planning.

Misaligned pathways create silent losses.

Review whether amputation cases are consistently coded accurately. Invest in focused documentation support where gaps exist.

Revenue defense is as important as cost control.

DRG readiness is not a one-time project. Establish regular reviews of episode performance, not just quarterly financials.

Regular review builds discipline.

Under DRGs, leadership must think in terms of systems, not departments. Finance teams play a key role in shaping this mindset.

Clear communication about where losses occur helps leadership support necessary changes.

Transparency builds alignment.

Amputation care is complex but manageable. Improvements here often translate well to other bundled or DRG-based services.

Success in this area builds confidence across the organization.

Learning spreads.

Hospitals that master DRG-based care gain stability while others struggle. This creates competitive advantage in payer negotiations and partnerships.

Prepared systems lead the market.

DRG and case-rate models do not punish care. They punish inefficiency, delay, and poor coordination. In amputation care, these issues are common but also fixable.

Finance teams that understand the true drivers of cost under DRGs move from reporting losses to shaping outcomes. By tracking the right signals, working closely with clinical teams, and investing in timing and coordination, they turn amputation episodes into predictable, well-managed pathways.

DRG readiness is not about doing less. It is about doing the right things earlier, together, and with clarity. For finance teams, this shift is no longer optional. It is the path to sustainable performance in a fixed-payment world.

For many clinicians, the surgery is only the first step. What happens after the operation

For trauma amputees, the journey does not begin at the prosthetic clinic. It begins much

Amputation after cancer is not just a surgical event. It is the end of one

When a child loses a limb, the challenge is never only physical. A child’s body

Last updated: November 10, 2022

Thank you for shopping at Robo Bionics.

If, for any reason, You are not completely satisfied with a purchase We invite You to review our policy on refunds and returns.

The following terms are applicable for any products that You purchased with Us.

The words of which the initial letter is capitalized have meanings defined under the following conditions. The following definitions shall have the same meaning regardless of whether they appear in singular or in plural.

For the purposes of this Return and Refund Policy:

Company (referred to as either “the Company”, “Robo Bionics”, “We”, “Us” or “Our” in this Agreement) refers to Bionic Hope Private Limited, Pearl Haven, 1st Floor Kumbharwada, Manickpur Near St. Michael’s Church Vasai Road West, Palghar Maharashtra 401202.

Goods refer to the items offered for sale on the Website.

Orders mean a request by You to purchase Goods from Us.

Service refers to the Services Provided like Online Demo and Live Demo.

Website refers to Robo Bionics, accessible from https://robobionics.in

You means the individual accessing or using the Service, or the company, or other legal entity on behalf of which such individual is accessing or using the Service, as applicable.

You are entitled to cancel Your Service Bookings within 7 days without giving any reason for doing so, before completion of Delivery.

The deadline for cancelling a Service Booking is 7 days from the date on which You received the Confirmation of Service.

In order to exercise Your right of cancellation, You must inform Us of your decision by means of a clear statement. You can inform us of your decision by:

We will reimburse You no later than 7 days from the day on which We receive your request for cancellation, if above criteria is met. We will use the same means of payment as You used for the Service Booking, and You will not incur any fees for such reimbursement.

Please note in case you miss a Service Booking or Re-schedule the same we shall only entertain the request once.

In order for the Goods to be eligible for a return, please make sure that:

The following Goods cannot be returned:

We reserve the right to refuse returns of any merchandise that does not meet the above return conditions in our sole discretion.

Only regular priced Goods may be refunded by 50%. Unfortunately, Goods on sale cannot be refunded. This exclusion may not apply to You if it is not permitted by applicable law.

You are responsible for the cost and risk of returning the Goods to Us. You should send the Goods at the following:

We cannot be held responsible for Goods damaged or lost in return shipment. Therefore, We recommend an insured and trackable courier service. We are unable to issue a refund without actual receipt of the Goods or proof of received return delivery.

If you have any questions about our Returns and Refunds Policy, please contact us:

Last Updated on: 1st Jan 2021

These Terms and Conditions (“Terms”) govern Your access to and use of the website, platforms, applications, products and services (ively, the “Services”) offered by Robo Bionics® (a registered trademark of Bionic Hope Private Limited, also used as a trade name), a company incorporated under the Companies Act, 2013, having its Corporate office at Pearl Heaven Bungalow, 1st Floor, Manickpur, Kumbharwada, Vasai Road (West), Palghar – 401202, Maharashtra, India (“Company”, “We”, “Us” or “Our”). By accessing or using the Services, You (each a “User”) agree to be bound by these Terms and all applicable laws and regulations. If You do not agree with any part of these Terms, You must immediately discontinue use of the Services.

1.1 “Individual Consumer” means a natural person aged eighteen (18) years or above who registers to use Our products or Services following evaluation and prescription by a Rehabilitation Council of India (“RCI”)–registered Prosthetist.

1.2 “Entity Consumer” means a corporate organisation, nonprofit entity, CSR sponsor or other registered organisation that sponsors one or more Individual Consumers to use Our products or Services.

1.3 “Clinic” means an RCI-registered Prosthetics and Orthotics centre or Prosthetist that purchases products and Services from Us for fitment to Individual Consumers.

1.4 “Platform” means RehabConnect™, Our online marketplace by which Individual or Entity Consumers connect with Clinics in their chosen locations.

1.5 “Products” means Grippy® Bionic Hand, Grippy® Mech, BrawnBand™, WeightBand™, consumables, accessories and related hardware.

1.6 “Apps” means Our clinician-facing and end-user software applications supporting Product use and data collection.

1.7 “Impact Dashboard™” means the analytics interface provided to CSR, NGO, corporate and hospital sponsors.

1.8 “Services” includes all Products, Apps, the Platform and the Impact Dashboard.

2.1 Individual Consumers must be at least eighteen (18) years old and undergo evaluation and prescription by an RCI-registered Prosthetist prior to purchase or use of any Products or Services.

2.2 Entity Consumers must be duly registered under the laws of India and may sponsor one or more Individual Consumers.

2.3 Clinics must maintain valid RCI registration and comply with all applicable clinical and professional standards.

3.1 Robo Bionics acts solely as an intermediary connecting Users with Clinics via the Platform. We do not endorse or guarantee the quality, legality or outcomes of services rendered by any Clinic. Each Clinic is solely responsible for its professional services and compliance with applicable laws and regulations.

4.1 All content, trademarks, logos, designs and software on Our website, Apps and Platform are the exclusive property of Bionic Hope Private Limited or its licensors.

4.2 Subject to these Terms, We grant You a limited, non-exclusive, non-transferable, revocable license to use the Services for personal, non-commercial purposes.

4.3 You may not reproduce, modify, distribute, decompile, reverse engineer or create derivative works of any portion of the Services without Our prior written consent.

5.1 Limited Warranty. We warrant that Products will be free from workmanship defects under normal use as follows:

(a) Grippy™ Bionic Hand, BrawnBand® and WeightBand®: one (1) year from date of purchase, covering manufacturing defects only.

(b) Chargers and batteries: six (6) months from date of purchase.

(c) Grippy Mech™: three (3) months from date of purchase.

(d) Consumables (e.g., gloves, carry bags): no warranty.

5.2 Custom Sockets. Sockets fabricated by Clinics are covered only by the Clinic’s optional warranty and subject to physiological changes (e.g., stump volume, muscle sensitivity).

5.3 Exclusions. Warranty does not apply to damage caused by misuse, user negligence, unauthorised repairs, Acts of God, or failure to follow the Instruction Manual.

5.4 Claims. To claim warranty, You must register the Product online, provide proof of purchase, and follow the procedures set out in the Warranty Card.

5.5 Disclaimer. To the maximum extent permitted by law, all other warranties, express or implied, including merchantability and fitness for a particular purpose, are disclaimed.

6.1 We collect personal contact details, physiological evaluation data, body measurements, sensor calibration values, device usage statistics and warranty information (“User Data”).

6.2 User Data is stored on secure servers of our third-party service providers and transmitted via encrypted APIs.

6.3 By using the Services, You consent to collection, storage, processing and transfer of User Data within Our internal ecosystem and to third-party service providers for analytics, R&D and support.

6.4 We implement reasonable security measures and comply with the Information Technology Act, 2000, and Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011.

6.5 A separate Privacy Policy sets out detailed information on data processing, user rights, grievance redressal and cross-border transfers, which forms part of these Terms.

7.1 Pursuant to the Information Technology Rules, 2021, We have given the Charge of Grievance Officer to our QC Head:

- Address: Grievance Officer

- Email: support@robobionics.in

- Phone: +91-8668372127

7.2 All support tickets and grievances must be submitted exclusively via the Robo Bionics Customer Support portal at https://robobionics.freshdesk.com/.

7.3 We will acknowledge receipt of your ticket within twenty-four (24) working hours and endeavour to resolve or provide a substantive response within seventy-two (72) working hours, excluding weekends and public holidays.

8.1 Pricing. Product and Service pricing is as per quotations or purchase orders agreed in writing.

8.2 Payment. We offer (a) 100% advance payment with possible incentives or (b) stage-wise payment plans without incentives.

8.3 Refunds. No refunds, except pro-rata adjustment where an Individual Consumer is medically unfit to proceed or elects to withdraw mid-stage, in which case unused stage fees apply.

9.1 Users must follow instructions provided by RCI-registered professionals and the User Manual.

9.2 Users and Entity Consumers shall indemnify and hold Us harmless from all liabilities, claims, damages and expenses arising from misuse of the Products, failure to follow professional guidance, or violation of these Terms.

10.1 To the extent permitted by law, Our total liability for any claim arising out of or in connection with these Terms or the Services shall not exceed the aggregate amount paid by You to Us in the twelve (12) months preceding the claim.

10.2 We shall not be liable for any indirect, incidental, consequential or punitive damages, including loss of profit, data or goodwill.

11.1 Our Products are classified as “Rehabilitation Aids,” not medical devices for diagnostic purposes.

11.2 Manufactured under ISO 13485:2016 quality management and tested for electrical safety under IEC 60601-1 and IEC 60601-1-2.

11.3 Products shall only be used under prescription and supervision of RCI-registered Prosthetists, Physiotherapists or Occupational Therapists.

We do not host third-party content or hardware. Any third-party services integrated with Our Apps are subject to their own terms and privacy policies.

13.1 All intellectual property rights in the Services and User Data remain with Us or our licensors.

13.2 Users grant Us a perpetual, irrevocable, royalty-free licence to use anonymised usage data for analytics, product improvement and marketing.

14.1 We may amend these Terms at any time. Material changes shall be notified to registered Users at least thirty (30) days prior to the effective date, via email and website notice.

14.2 Continued use of the Services after the effective date constitutes acceptance of the revised Terms.

Neither party shall be liable for delay or failure to perform any obligation under these Terms due to causes beyond its reasonable control, including Acts of God, pandemics, strikes, war, terrorism or government regulations.

16.1 All disputes shall be referred to and finally resolved by arbitration under the Arbitration and Conciliation Act, 1996.

16.2 A sole arbitrator shall be appointed by Bionic Hope Private Limited or, failing agreement within thirty (30) days, by the Mumbai Centre for International Arbitration.

16.3 Seat of arbitration: Mumbai, India.

16.4 Governing law: Laws of India.

16.5 Courts at Mumbai have exclusive jurisdiction over any proceedings to enforce an arbitral award.

17.1 Severability. If any provision is held invalid or unenforceable, the remainder shall remain in full force.

17.2 Waiver. No waiver of any breach shall constitute a waiver of any subsequent breach of the same or any other provision.

17.3 Assignment. You may not assign your rights or obligations without Our prior written consent.

By accessing or using the Products and/or Services of Bionic Hope Private Limited, You acknowledge that You have read, understood and agree to be bound by these Terms and Conditions.